In today’s rapidly evolving financial landscape, Trading With a Full-Time Job is no longer limited to market professionals or full-time traders. With the growth of online trading platforms, mobile apps, and easily accessible financial education, many working professionals are now exploring trading as a secondary source of income alongside their regular jobs.

However, managing trading responsibilities while maintaining a full-time career is far more challenging than it appears and requires a disciplined, realistic, and well-planned approach.

However, managing trading alongside a full-time job is far from simple. Limited time, emotional pressure, and lack of proper planning often lead to poor decisions and losses.

The reality is that trading success for job holders depends not on constant screen time, but on discipline, strategy selection, risk management, and emotional control.

This comprehensive guide is designed specifically for salaried individuals who want to trade without affecting their career, mental health, or personal life.

Whether you are a beginner or someone with basic market experience, this article will help you understand how to trade realistically, safely, and consistently while working a 9-to-5 job.

Why Working Professionals Are Attracted to Trading?

1. Additional Source of Income

With rising inflation, living costs, and financial responsibilities, many salaried individuals look for ways to supplement their income. Trading can provide an extra income stream when approached correctly.

2. Desire for Financial Independence

Trading offers the potential to grow capital faster than traditional savings methods, which attracts people seeking long-term financial freedom.

3. Interest in Stock Markets

Many professionals enjoy analyzing charts, tracking companies, and understanding economic trends, making trading intellectually engaging.

4. Easy Access and Low Entry Barrier

Today, anyone can start trading with a small amount of capital, a smartphone, and an internet connection.

That said, trading is not a shortcut to quick money. It is a skill that requires patience, learning, and experience.

The Reality of Trading While Doing a Job

Before starting, it is important to accept certain truths:

- You cannot track markets throughout the day

- High-frequency scalping is unrealistic

- Emotional pressure can be higher

- Losses are unavoidable

- Consistency matters more than occasional big profits

Most job holders fail not because trading doesn’t work, but because they choose strategies that don’t match their lifestyle.

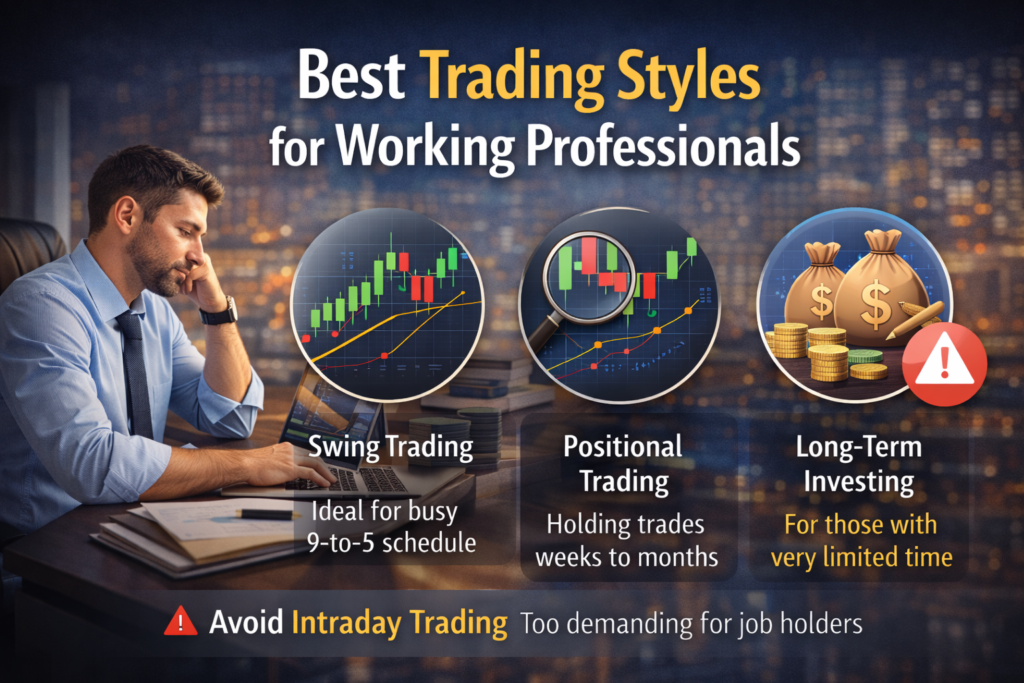

Best Trading Styles for Working Professionals

1. Swing Trading (Most Suitable Option)

Swing trading involves holding trades for a few days to a few weeks.

Why it works for job holders:

- No need to watch charts all day

- Analysis can be done after market hours

- Lower stress compared to intraday trading

- Suitable for equities and limited options trading

2. Positional Trading

Positional traders hold trades for weeks or months.

Best suited for:

- Busy professionals

- Those combining technical and fundamental analysis

- Long-term market participants

3. Long-Term Investing

If you cannot dedicate even 30 minutes daily, long-term investing is a better alternative than active trading.

Why Intraday Trading Should Be Avoided

Intraday trading demands continuous attention during market hours, making it unsuitable for full-time employees.

How Much Time Is Actually Required?

You don’t need hours every day.

Practical time allocation:

- 30–45 minutes after market close for analysis

- 10–15 minutes in the morning to place orders

- Weekends for learning and review

Consistency is far more important than time spent.

Setting Realistic Trading Expectations

Realistic Goals:

- 2–5% consistent monthly returns

- Focus on process over profits

- Gradual capital growth

Unrealistic Expectations:

- Doubling capital in a month

- Recovering losses emotionally

- Depending on trading income immediately

Trading rewards patience, not greed.

Capital Management for Job Holders

Never trade using money meant for:

- Rent or EMI

- Household expenses

- Emergency savings

Essential Rules:

- Start with small capital

- Risk only 1–2% per trade

- Maintain a separate emergency fund

- Never borrow money to trade

Capital protection is the foundation of long-term success.

Risk Management: The Backbone of Survival

A working professional cannot afford large drawdowns.

Basic Risk Rules:

- Always use stop-loss orders

- Never average losing positions

- Avoid revenge trading

- Limit the number of trades per week

One bad trade should never affect your job performance or mental peace.

Tools That Save Time for Job Traders

Technology makes trading manageable for professionals.

Essential tools include:

- TradingView for chart analysis

- Broker mobile applications

- Economic calendars

- Price alerts

- Trading journals or spreadsheets

Automation reduces emotional decisions and saves time.

Creating a Simple and Effective Trading Plan

Your trading plan should clearly define:

- Markets you will trade

- Timeframes used

- Entry and exit rules

- Risk per trade

- Maximum trades per week

Strictly following a plan is more important than having a complex strategy.

Psychological Challenges Faced by Working Traders

Most failures occur due to mindset issues.

Common Challenges:

- Overtrading due to excitement

- Stress after losses

- Checking charts during office hours

- Fear of missing out (FOMO)

Practical Solutions:

- Accept losses as business expenses

- Limit screen time

- Focus on long-term consistency

- Avoid emotional trading

Mental discipline matters more than strategy.

Learning Trading While Working Full-Time

Expensive courses are not necessary.

Effective learning methods:

- Free online educational content

- Books on trading psychology

- Backtesting strategies

- Daily chart observation

Continuous but controlled learning is key.

Using Weekends Productively

Weekends are an advantage for job traders.

Weekend tasks:

- Market research

- Stock screening

- Trade review

- Learning new concepts

- Planning for the upcoming week

Preparation happens when markets are closed.

When Should You Consider Full-Time Trading?

Full-time trading should be considered only if:

- You have 12–18 months of consistent profitability

- Trading income exceeds your salary

- You have sufficient backup savings

- You are emotionally stable

Never quit your job after one good month.

Common Mistakes to Avoid

- Following tips blindly

- Trading without stop-loss

- Overconfidence after profits

- Frequently changing strategies

- Comparing results with others

Focus on your own journey.

Balancing Career, Trading, and Personal Life

Your job and health should always come first.

Practical Tips:

- Fixed trading routine

- No trading during office hours

- Take breaks after losses

- Spend time with family

- Maintain physical fitness

Trading should support your life, not control it.

Is Trading With a Job Worth It?

Yes—when done correctly.

Trading alongside a job:

- Builds financial discipline

- Improves decision-making skills

- Can generate additional income

- Encourages continuous learning

But it demands patience, consistency, and emotional maturity.

Final Thoughts

Trading with a full-time job is absolutely possible when approached with realism and discipline. You don’t need to be perfect—you need to be consistent. Choose the right trading style, manage risk strictly, control emotions, and focus on steady long-term growth.

Slow progress with peace of mind is far better than fast profits with stress.

If you treat trading like a business rather than a gamble, it can become a powerful wealth-building tool alongside your career.